The Risk Management Safety Net:

VII. Considerations for Capturing Market Potential

A comparison of insurance availability and Federal crop insurance sales to NASS state data for the crop can provide information about market potential that could be captured by expansion of the insurance product to additional states or counties. The majority of permanent Federal crop insurance policies allow ‘written agreements’ which are a method of obtaining insurance in a county, as long as underwriting can be satisfactorily performed, even if the program is not offered in that specific county.

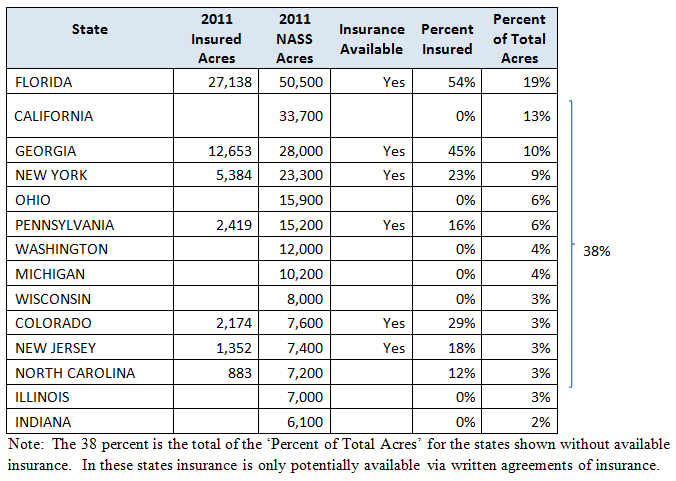

For example: Fresh Market Sweet Corn Federal crop insurance had a relatively low market penetration at a little over 20 percent, so its availability is compared with NASS data in the following table. The table is sorted from largest to smallest NASS reported acres of fresh market sweet corn.

Fresh Market Sweet Corn Market Penetration and Availability

In this example, there is a 38 percent share of the market that does not have Fresh Market Sweet Corn insurance directly available in their region. Federal crop insurance programs are generally put into main growing areas for crops where expressed interest exists and later expanded when needs are identified in additional areas. Because of market sensitivity, on occasion producer groups may request a specific crop insurance program not be offered in specific states. However, needs and preferences can change over time. Weather changes, prices, consumer demand, variety and agronomical improvements can make large differences in where crops are grown and what crops are grown. The table above shows several states with NASS acres but no insurance program available, which can suggest there may be market potential that could be further researched for potential program expansion.

Note that for Fresh Market Sweet Corn, some states like North Carolina have insured acres but no insurance available, which means that all policies there are being obtained by producers through written agreements.

Consideration of expansion of an existing Federal crop insurance program to new areas requires careful research and underwriting to determine growing practices, crop risks and appropriateness of the insurance program to production practices and markets (prices) in the specific area before any program expansion can occur.

Some other considerations useful in capturing market potential are:

- Determinations that risks covered by the insurance policy and procedures used are effective for the industry.

- There is producer demand for the risk management product.

- Rates reflect the risks covered. (Rates in existing program areas are reviewed on a regular basis.)

- Producers and agents understand what the insurance products cover and the value of coverage. Outreach and education efforts can be important for this component.

- Agents are available to sell and service policies.

- Any other barriers to participation are identified and removed.

Contact Information

For more information, contact RMA Public Affairs.

|